The bill would also allow the Federal Housing Administration to insure loans up to the same $729,750 limit. President George W. Bush said today he will sign the bill next week.

See full article at: Jumbo' Loan Increase May Not Stem Housing Decline

Breaking Down the Jumbo Loan Increase

Here's a couple points from my friend in the mortgage business.

- It is based off median house limits on an area. It is not based off current conforming limits ($417k). Details to be posted officially.

- There will be a slight waiting period for the changes to be integrated into the system. (This isn't going to happen right away. Weeks if not months.)

- The bill still has to pass the Senate (who vetoed it the first time) and the president (who is unlikely to veto it).

- The bill affects loans originated from July 2007 to December 2008

The issue right now is that investors will not buy certain loans on Wall Street. Mortgage companies who used their lines of credit to fund these types of loans cannot sell them. This ties up the available capital and forces the lenders to tap their own funds to fund these loans. A side effect of this is that some lenders have already gone out of business (see American Homes). If this bill is passed, many of these loans can be sold to Fannie Mae and Freddie Mac, which will allow lenders to get these loans off their lines so they can continue to use the line to fund new loans. This allows the lender to do business without using its own capital. If Fannie Mae and Freddie Mac will buy them, these will immensely relieve the pressure that is in the system right now.

Impact on Buyers

It all depends on the median housing limit in your area. This could be a dramatic reduction in monthly costs for those in jumbo loans. I'm estimating the current spread between a conforming and a jumbo loan is currently about 1.5%. This has traditionally been about 0.5%. Refinancing might be a great idea in the near future. If this bill reduces your interest rate by 1.5%, that is a 10-15% increase in buying power!!

Conclusion

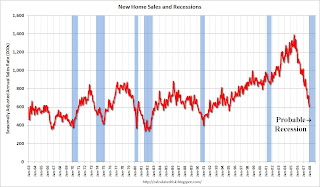

This part of the bill might actually help bottom out the anemic real estate market.

It really depends entirely on the median housing limits. Allowing the lenders to flush out the loans in their system is a good thing in itself. Hopefully, it will also restore some balance and some investor and buyer appetite. That said, it may take a little while for things to pick up as it takes time for people to get past the investments that may have burned them in the past.

This bill has a high potential impact on the ~$500,000 to ~$900,000 market. If the max jumbo increased to $700k, the reduction of 10-15% on monthlies would probably be a nice boost for those with a longer term view. Of course, this might stall the market until it actually happens.